Import Export Code - Registration Online

Want to Start Import Export Business From India?

If you are looking to start a Import Export Business From India. You just need to IE-Code right before starting.

Just Send us Details, Easebis has team of Professionals who help you to Get IE-Code.

- Easy process

- Fast and hassle-free

- Availability of In-house experts

- Complete online documentation

Get Started!

Import Export Code - An Overview

An Importer Exporter Code (IEC) is crucial business identification number which mandatory for export from India or Import to India. Unless specifically exempted, any person shall make no export or import without obtaining an IEC. For services exports, however, IEC shall not be necessary except when the service provider is taking benefits under the Foreign Trade Policy. Consequent to the introduction of GST, IEC being issued is the same as the PAN of the Firm. However, the IEC will still be separately published by DGFT based on an application. This article looks at the procedure for making an IE Code application in detail.

Importance of Import Export Code

Businesses have a great option to enter the international market with the export and import of the products and the services they are involved in. The IE code is an essential requirement while entering the global market as it supports the growth and development of the business to a certain extent. There are various advantages of getting an Import Export Code. Here we have listed a few of them:

- International market unlocks: As the IE Code is a requirement for the import and export business, they allow the products to reach the global market. IE code makes the entry of the international Indian company smoother and opens doors for growth and expansion.

- Online registration: The process to find the IE Code is entirely online and hassle-free with short document submission.

- Less document requirement: It is not required to submit many documents to obtain an IEC.

- Lifetime Validity: IE Code is a lifetime registration valid as long as the business exists. Hence, there are no issues with updating, filing, and renewing Import Export Code registration. The IE registration is valid until the company exists or the registration is not revoked or surrendered.

- Reduces illegal goods transportation: The most basic requirement for the Import-Export code is that you need to provide authentic information. Without giving proper information, IE code cannot be obtained. This criterion makes the transportation of illegal goods impossible.

- Availing Several Benefits: IE code has enormous benefits for importers and exporters. The registered business entities can get help through subsidies from the Customs, Export Promotion Council or other authorities. With LUT filing under GST, the exporters can make exports without paying taxes. If the exports are made with tax payment, the exporter can claim the refunds of the paid tax amount.

- Compliances: Unlike other tax registration, the person carrying import or export does not require to fulfill any specific compliance requirements such as the annual filing or the return filings.

Validity of IEC Code

As mentioned above, IE Code registration is permanent and valid for a lifetime. Hence, there will be no hassles with updating, filing, and renewing the IEC registration. It is valid till the business exists or the registration is not revoked or surrendered. Further, unlike tax registrations like GST registration or PF registration, the importer or exporter does not require to file any filings or follow any other compliance requirements like annual filing.

As IE code registration is one-time and requires no additional compliance, it is recommended for all exporters & importers to obtain IE code after incorporation.

Nature of the Firm obtaining an IEC

The nature of the Firm obtaining an IEC may be any of the follows:

- Proprietorship Firm

- Partnership Firm

- Limited Liability Partnership

- Limited Company

- Trust

- Hindu Undivided Family (HUF)

- Society

Pre-Requisites for Applying for IEC

- Valid Login Credentials to DGFT Portal (After Registering on DGFT Portal)

- IEC may be applied on behalf of a firm which may be a Proprietorship, Partnership, LLP, Limited Company, Trust, HUF, and Society.

- The Firm must have an active Firm’s Permanent Account Number (PAN) and details like Name as per Pan, Date of Birth, or Incorporation.

- The Firm must also have a bank account in the Name of the Firm and a valid address before applying.

Note: These details will be validated with the Income Tax Department site.

Documents required for IEC Code registration

The list of scanned documents required for IEC Registration is listed as follows:

- Proof of establishment/incorporation/registration: The following type of Firm needs to submit the establishment/incorporation/registration certificate:

- Partnership

- Registered Society

- Trust

- HUF

- Other

- Proof of Address: Proof of Address can be any one of the following documents:

- Sale Deed

- Rent agreement

- Lease deed

- Electricity bill

- Telephone landline bill

- Mobile, post-paid bill

- MoU

- Partnership deed

- Other acceptable documents (for proprietorship only):

- Aadhar card

- Passport

- Voter id

Note: In case the address proof is not in the Name of the applicant firm, a no objection certificate (NOC) by the firm premises owner in favor of the Firm, along with the address proof, is to be submitted as a single PDF document.

- Proof of Firm’s Bank Account

- Cancelled Cheque

- Bank Certificate

- User should have an active DSC or Aadhaar of the Firm’s member for submission.

- Active Firm’s Bank accounts for entering its details in the Application and making online payment of the application fee.

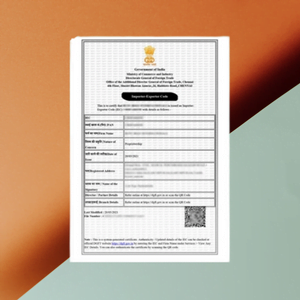

Get Importer Exporter Code Certificate

The User shall receive the IEC Certificate in the email (used while applying for IEC). If required, the User can download the IEC Certificate after login into the DGFT and using the “Print Certificate” feature in “Manage IEC.”

The IEC shall be transmitted to CBIC, and the transmission status can be seen by Navigating to “My IEC” and checking the IEC Status bar with “CBIC Transmission Status.”

The Import Export Code is a primary document that is necessary for commencing Import-export activities. For exporting or importing any goods or services the IE code is to be obtained.IEC has numerous benefits for the growth of the business. Certainly, you cannot ignore the necessity of IE code registration as it is mandatory. You can apply for an Import Export code through Easebis and obtain it within 6 to 7 days.

Why Choose Easebis

8756 +Happy Customers

700 +Company Registered

20+ Team Members & CA

4 . 8 Google Rating & Positive Reviews

Frequently Asked Questions (FAQs)

The documents required for an Import Export Code (IEC) application typically include proof of identity (such as PAN card, Aadhaar card, or passport), proof of address (such as voter ID, driving license, or utility bill), bank account details, and relevant business entity documents (such as company incorporation certificate, partnership deed, or proprietorship registration).

Yes, amendments or corrections to an Import Export Code (IEC) can be made if required. Any changes in the information provided during the application process, such as business address or bank account details, should be updated with the DGFT. It is important to keep the IEC information accurate and up to date.

Yes, there is a fee associated with obtaining an Import Export Code (IEC). The fee amount may vary and is specified by the DGFT. The fee can be paid online during the application process.

Yes, an Import Export Code (IEC) can be used for multiple businesses or ventures under the same legal entity. However, separate IECs are required for different legal entities, such as separate IECs for different companies or partnerships. It is not permissible to use the same IEC for unrelated businesses or entities

There are no specific due dates for filing an Import Export Code (IEC) application. It can be submitted throughout the year. However, it is advisable to apply for an IEC well in advance of any planned import or export activities to ensure a smooth process.

Testimonials

Team EaseBis came to the rescue in crunch time. They were prompt, courteous and professional. Superlative service at super competitive price. Couldn't be more satisfied.

I was very lucky to be connected with Rashmita C, one of the consultants with this company. She is a great asset to the company, she is knowledgeable and helped me with my questions in a very professional manner and very little time considering the fact that there is rush in March

Highly impressed by the Turn around time of EaseBis. Got my company registered & filed the trademark. It was a seamless experience & amazed - had to not visit them even once. These guys are super reliable!

Excellent customer service from EaseBis team. Right from the time, the business engagement starts to the completion of e-filing and tax refund (if applicable), the team at EaseBis constantly assists the customer and is proactive to resolve queries in the shortest possible time.

Yes, the application for an Import Export Code (IEC) can be submitted online through the official website of the Directorate General of Foreign Trade (DGFT). The online application process has made it convenient and efficient to apply for an IEC.