GST LUT Form (Letter of Undertaking)

Filing of GST LUT Form for Exporters.

- Easy process

- Fast and hassle-free

- Availability of In-house experts

- Complete online documentation

Get Started!

Why Choose Easebis to file GST Lut Form?

GST RFD-11 Form, Eligibility & Process to fill the Documents

What does LUT under GST means?

LUT in GST: Full form/meaning is Letter of Undertaking. It is prescribed to be furnished in the form GST RFD 11 under rule 96 A, whereby the exporter declares that he or she will fulfill all the requirement that is prescribed under GST while exporting without making IGST payment.

Who needs to file LUT in Form GST RFD-11?

GST LUT is to be submitted by all GST registered goods and service exporters. The exporters who have been prosecuted for any offense and the tax evasions exceeding Rs 250 lakhs under CGST Act or the Integrated Goods and Service Act, 2017 or any existing laws are not eligible to file the GST LUT. In such cases, they would have to furnish an Export bond.

Here the motive of the government was to expand the export base by providing reliefs on exports. GST experts from Easebis can help you with GST LUT filing or Export bond Filing.

Under CGST Rules,2017, any registered person can furnish an Export bond or LUT in GST RFD 11 without paying the integrated tax. They can apply for LUT if:

- They intend to supply goods or services to India or overseas or SEZs

- Are registered under GST

- They wish to supply goods without paying the integrated tax.

Documents Required for LUT under GST

An LUT can be submitted by any individual who is registered under GST provided he has not been executed in case of tax evasion exceeding Rs.250 lakh or any other offense.

- LUT cover letter – request for acceptance – duly signed by an authorized person

- Copy of GST registration

- PAN card of the entity

- KYC of the authorized person/signatory

- GST RFD11 form

- Copy of the IEC code

- Canceled Cheque

- Authorized letter

Process for Filing LUT in GST?

To file a Letter of Undertaking (LUT) in a case where the exports are made without payment of taxes, below are the steps on how to file and furnish bonds when the exports are made without payment of taxes.

Check the furnishing and jurisdiction requirements. If a bond is to be filed, additional documents relating to the bank guarantee must be prepared.

Prepare necessary documents for Bonds. Following documents are to be filed for bonds:

For Bonds:

- Form RFD-11

- Bond on stamp paper

- Bank guarantee

- Authority letter

- Other supporting documents

A separate bond is not needed to be furnished for each consignment. Instead, he can furnish a running bond. A running bond helps the exporter to carry forward the same terms and conditions in the bond for the next consignment.

A duplicate copy should be prepared along with an official document.

The next step is to submit the documents to the department and get the same verified by a relevant officer to avoid any rejection

After filing the document, a signed letter shall be issued by the officer acknowledging the same.

Eligibility for Filing LUT in GST

Who can use Letter of Undertaking (LUT)?

Any registered taxpayer who is into exporting goods and services can make use of Letter of Undertaking. Any person who has been prosecuted for tax evasion for an amount of Rs. 250 lakh or above are ineligible.

The validity of such LUT’s is for one year, and an exporter is required to furnish a fresh LUT for each financial year. If the conditions mentioned in the LUTs are not satisfied within the specified time limit, then the privileges will be revoked, and the exporter will have to furnish bonds.

Other assesses should furnish bonds if the export is being made without the payment of IGST. LUTs / Bonds can be used for:

- Zero-rated supply to SEZ without payment of IGST

- Export of goods to a country outside India without the payment of IGST.

- It is providing services to a client in a country outside India without paying IGST.

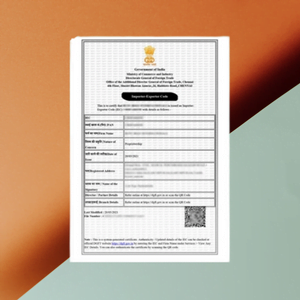

Filing of Letter of Undertaking (FORM GST RFD-11)

The Form RFD-11 is filed in the format below:

- Registered Name

- Address

- GST No.

- Date of furnishing

- Signature, date, and place

- Details of witnesses (Name, address, and occupation)

Export Bond for GST

Entities that are not eligible to submit a Letter of Undertaking based on the conditions mentioned will have to furnish an export bond and a bank guarantee. The applicant needs to cover the amount of tax involved in the export based on estimated tax liability self-assessment.

Export bond should be furnished on non-judicial stamp paper of the value as applicable in the State in which the bond is being furnished.

Also, exporters can furnish a running bond, so that export bond needs not to be executed for each export transaction. However, if the outstanding tax liability on exports exceeds the bond amount at any time, then the exporter must furnish a new bond to cover the additional liability.

A bank guarantee can be mandated along with an export bond. The value of the bank guarantee should usually not exceed 15% of the bond amount. However, based on the exporter’s track record, the bank guarantee required to be submitted with the export bond can be waived off by the jurisdictional GST Commissioner.

Form for Bonds:

-

Registered Name

-

Address

-

Date of furnishing

-

Amount of bank guarantee furnished.

-

Signature, date, and place

-

Details of witnesses (Name, address, and occupation)

Why Choose Easebis

8756 +Happy Customers

700 +Company Registered

20+ Team Members & CA

4 . 8 Google Rating & Positive Reviews

Frequently Asked Questions (FAQs)

After successful filing, the system will generate ARN and acknowledgment. You will be informed about successful filing via SMS and Email, and you can also download the acknowledgment as a PDF.

Yes, an LUT form can be filed even if the taxpayer has not yet started exporting goods or services, as long as they anticipate exporting during the financial year.

No, once an LUT form is filed and approved, it cannot be modified. However, a new LUT form can be filed to replace the old one.

An LUT form allows the taxpayer to export goods or services without paying any tax, while a bond requires the taxpayer to furnish a bank guarantee or a cash deposit.

The process for filing an LUT form involves filling out the form online, attaching the required documents, and submitting it to the GST department.

No, once an LUT form is approved, it cannot be withdrawn. However, a new LUT form can be filed to replace the old one.

No, a person cannot file an LUT form if they have any pending tax liability, including late fees or interest charges.

Testimonials

Team EaseBis came to the rescue in crunch time. They were prompt, courteous and professional. Superlative service at super competitive price. Couldn't be more satisfied.

I was very lucky to be connected with Rashmita C, one of the consultants with this company. She is a great asset to the company, she is knowledgeable and helped me with my questions in a very professional manner and very little time considering the fact that there is rush in March

Highly impressed by the Turn around time of EaseBis. Got my company registered & filed the trademark. It was a seamless experience & amazed - had to not visit them even once. These guys are super reliable!

Excellent customer service from EaseBis team. Right from the time, the business engagement starts to the completion of e-filing and tax refund (if applicable), the team at EaseBis constantly assists the customer and is proactive to resolve queries in the shortest possible time.

It is not mandatory, but if the Taxpayer wants to record the manually approved LUT to be available in online records, he can furnish it with the online application.